Irs Gift Tax Limit 2025 - This means that you can give anyone up to this amount. Annual Gift Tax Limit 2025 Aleda Aundrea, In 2025, you can give gifts of up to $18,000 to as many people as you want without any tax or reporting requirements. This amount, known as the annual gift tax exclusion.

This means that you can give anyone up to this amount.

Maximum Gift Irs 2025 Godiva Ruthie, For 2025, the annual gift tax exclusion is $18,000, meaning a person can give up to $18,000 to as many people as he or she wants without having to pay any taxes on the gifts. This amount, known as the annual gift tax exclusion.

Here’s how to know the difference and understand record.

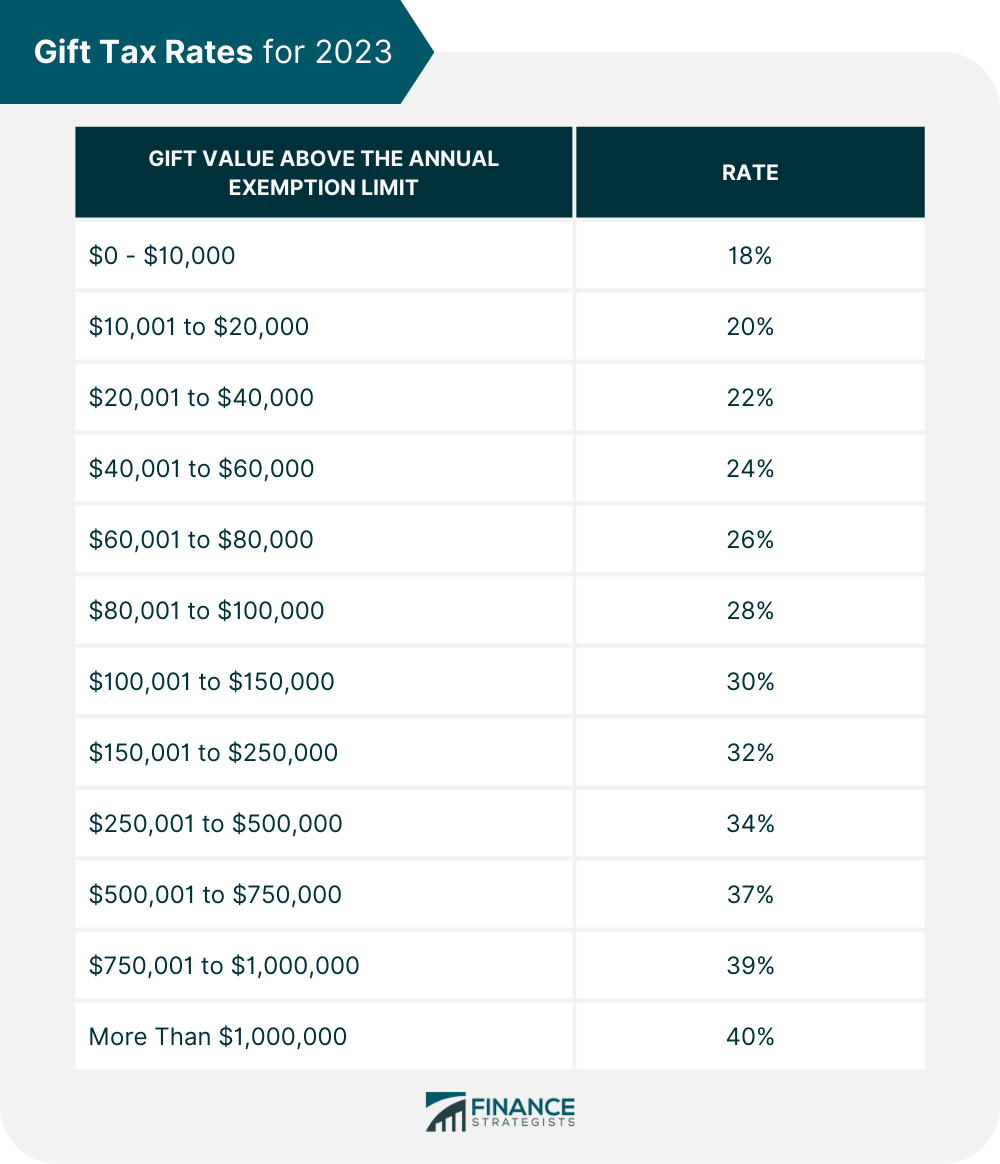

Gift Tax Rates 2025 Pepi Kristan, For the year 2025, the irs sets specific limits on the amount that can be given to any number of individuals without incurring a gift tax or even needing to file a gift tax return. The estate tax exemption in 2025 is $13.61 million for individuals and $27.22 million for couples.

What Is Annual Gift Tax Exclusion For 2025 Glynda Juliann, For 2025, the lifetime gift tax exemption is $13.61 million, up from $12.92 million in 2023. For 2025, the annual gift tax exclusion is $18,000, meaning a person can give up to $18,000 to as many people as he or she wants without having to pay any taxes on the gifts.

Find key dates, eligibility criteria, and how to maximize your tax benefits.

Indiana Gift Tax 2025 Erna Odette, The gift tax limit (or annual gift tax exclusion) for 2023 is $17,000 per recipient. Here’s how to know the difference and understand record.

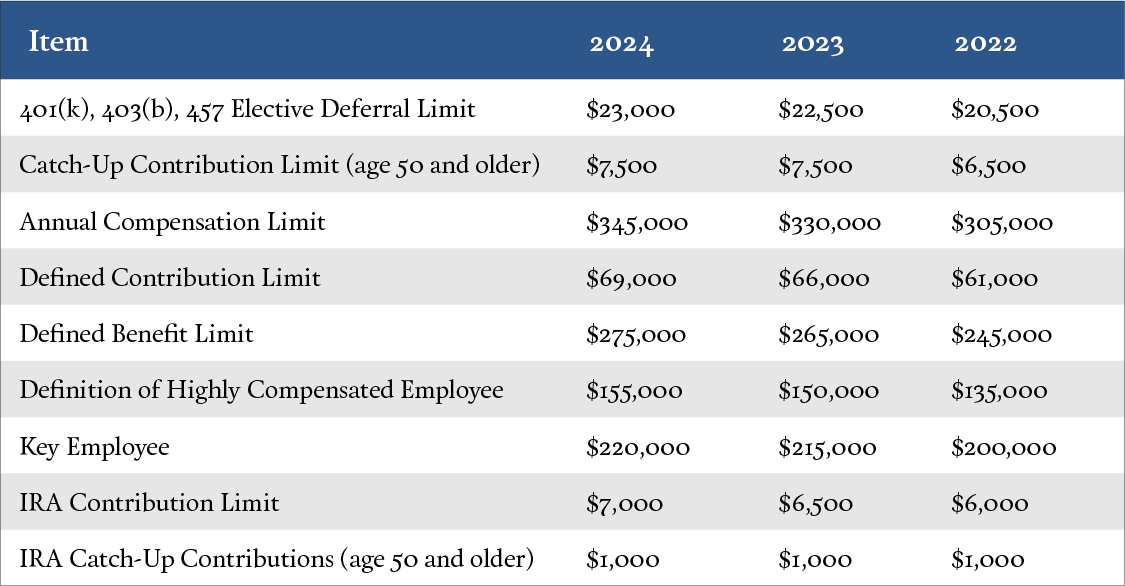

In 2025, a single taxpayer can claim a federal estate and lifetime gift tax exemption of $13.61 million (twice that for couples making joint gifts). The irs has announced increases in tax exemptions, qualified charitable distribution (qcd) gift limits, and standard deductions for 2025.

Irs Gift Tax Limit 2025. Find key dates, eligibility criteria, and how to maximize your tax benefits. The annual gift tax limit is $18,000 per person in 2025.

Irs Business Gift Limit 2025 Crin Mersey, Some gifts that a small business owner gives to their employees may be taxable, while others are not. Currently, you can give any number of people up to $17,000 each in a single year without taxation.

What Is Gifting Limit For 2025 Tandi Florella, This amount, known as the annual gift tax exclusion. The estate tax exemption in 2025 is $13.61 million for individuals and $27.22 million for couples.